Click to enlarge

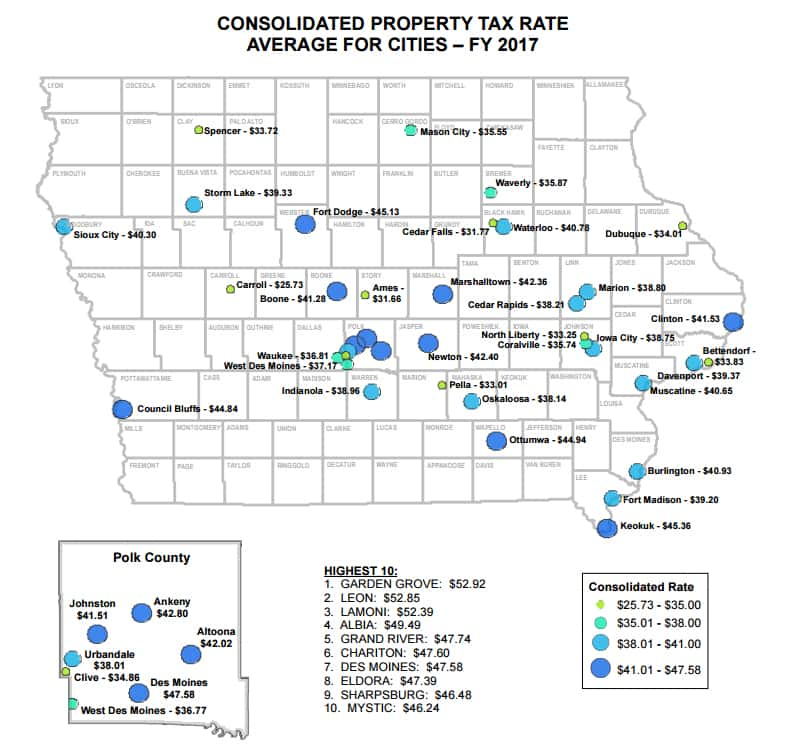

According to the Iowa Legislative Services Agency, among cities with over 10,000 people, Pella had the 4th lowest consolidated property tax rate in Iowa in Fiscal Year 2017.

The Tulip City averages a levy of $33.01 per $1000 of valuation, behind only Cedar Falls ($31.77) Ames ($31.66), and Carroll ($25.73). This year, the Pella City Council and Pella School Board voted to maintain their current rates for the upcoming fiscal year. The consolidated property tax rate is the aggregate of the property tax within the city divided by the total taxable valuation — with gas and electric utilities, within the city, multiplied by $1,000. Agricultural property located within corporate limits is not included in the average.

Find a full list of consolidated rates for every city in the state here.