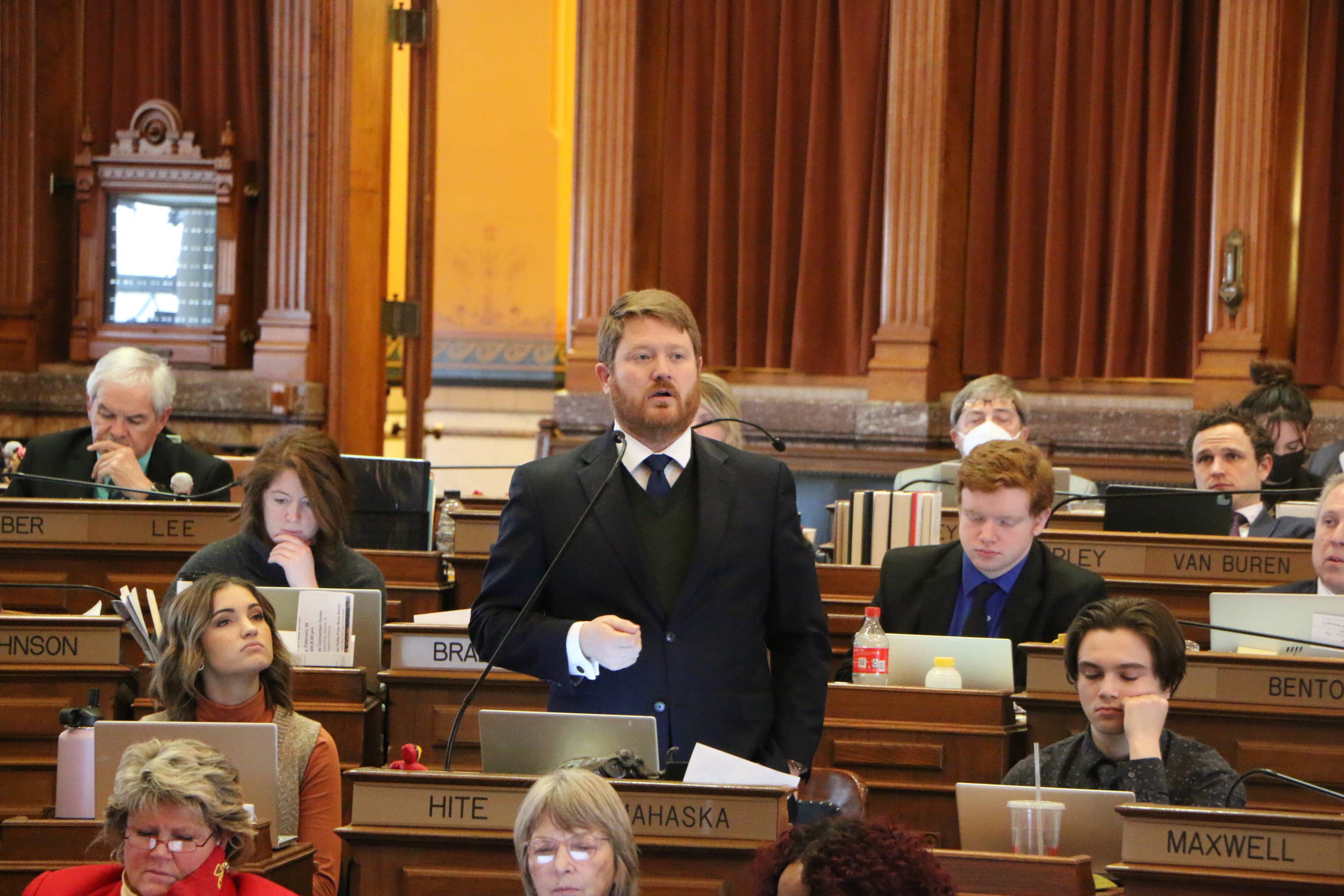

One of the key priorities for Iowa Republicans made its way through both chambers Thursday. State Representative Dustin Hite says an agreement was reached on House File 2317, which centers around proposed tax reform legislation this year.

“This bill is essentially the same that we passed off the House floor earlier this year with a few additions,” Hite says.

In his weekly newsletter, Hite says the following were included in the final package:

– All Iowa taxpayers will be moved to a flat 3.9% tax. This would be phased in over period of four years with the final flat tax being effective in tax year 2026.

– Corporate tax rates will be reduced when revenue generated from corporate taxes exceeds $700 million per year, until the rate reaches a flat rate of 5.5%. In addition, other corporate tax credits without a sunset will also have their refundability reduced.

– Taxpayers are allowed a once in a lifetime exclusion from income tax of the sale of capital stock held in ESOPs. This exclusion is phased in over three years starting in tax year 2023.

– Taxpayers who are at least 55 years old, who were active farmers for at least 10 years and retired, will be able to exempt their rental income from their farm ground beginning in tax year 2023. The farmer will need to elect this option or the capital gains exclusion in number three below.

– A retired Iowa Farmer will be able to exclude the gain from the sale of farm ground or livestock, one time in their life beginning in tax year 2023. They will need to elect between this option and the exclusion of rental income in number two above.

– Under current law, taxpayers are able to exclude the first $6,000.00 of retirement income (pensions, 401ks, IRAs) from income tax. This bill now provides a full exemption from taxes for retirement income beginning in tax year 2023

In Iowa, Hite says the Taxpayer Relief Fund was created as a way of providing tax relief to Iowans, and currently contains over $1 billion, and will be used in the event that revenue growth projections do not hit 3.5%. While a few Democrats supported the bills Thursday, the rest of the minority party has argued more should be invested in essential services, and that the tax cuts will overwhelmingly benefit the wealthy, and most low-to-middle income Iowans will see far less relief.