Ahead of the proposed extension of the Local Option Sales and Service Tax (LOSST) in Pella on September 13th, concerns have been raised about potential debt associated with the projects listed on the ballot.

The levy — which if approved, would keep a one-percent sales tax on all eligible purchases in the city limits through 2044 on top of the 6% from the state (totaling at 7%), and has been determined by the Pella City Council as the best way to pay off bonds that could be issued for a potential new indoor rec center, renovations to the Pella Community Center, and expansion of University Street east.

The City of Pella reported an estimated $1.85 million in collections from the one-percent sales tax in fiscal year 2021-22, and financial projections given to the Pella City Council earlier this year indicate that if that were to remain even, the potential revenue over a 20 year extension would be approximately $36 million, assuming no growth from the current rate of sales locally.

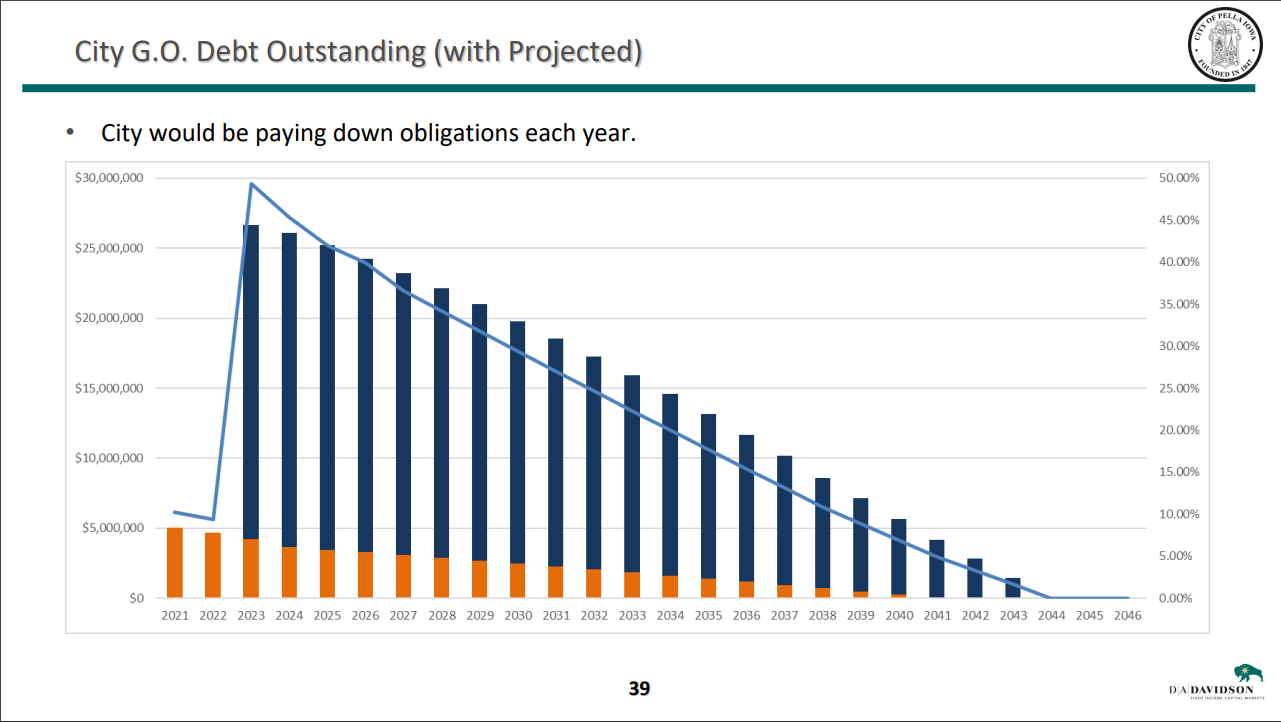

Pella Mayor Don DeWaard says for the $45 million minimum investment proposed for the quality-of-life projects and University Street extension, a financial presentation given to council in April called for $17 million in bonds issued by the city — which would be paid for by a portion of the revenue generated annually by the LOSST levy if it were to be extended. He says that number serves as the likely cap for debt issued by bonds for all projects combined, and after an additional $5 million commitment of current fund balance from the city, any additional increase in spending above $22 million would be a result of a combination of additional private donations and potential grants or contributions from Marion County and the State of Iowa. A $17 million bond loan amount would put the city at approximately 45% of its general obligation debt limit, which would drop annually assuming no other lending is used during that time frame, which was at just under 10% in fiscal year 2022, according to city financial advisor D.A. Davidson:

The LOSST ballot measure goes before City of Pella voters on Tuesday, September 13th, although in-person absentee voting is available at the Marion County Auditor’s Office in Knoxville until Monday the 12th during regular business hours.

Click here to read more about the presentation given to the Pella City Council in April.