In one week, voters in Pella will decide to whether or not extend the current Local Option Sales and Service Tax (LOSST) first approved by voters in 2001 and extended in 2011, which is set to expire at the end of 2023.

Currently, the total sales tax in Pella on any eligible goods is 7% — 6% is set by the state, and 1% goes to Marion County and the City of Pella. The existing local sales tax can be extended with a simple majority of those living in the city limits. Those wanting to participate can do so absentee at the Marion County Courthouse during regular hours until Monday the 12th, or in person at polling locations in Pella on the 13th.

—

Property Tax Relief Language Differs in 2022 vs. 2011 Extension

One of the largest points of contention for those opposed to the measure is that the ballot indicates 0% of the funds will be specifically dedicated to property tax relief — 20% was listed on the 2011 ballot. That language for the special referendum was ultimately approved by the Pella City Council at their June 21st meeting (read more below).

Pella Mayor Don DeWaard says by going to 0%, the council has far more flexibility to ensure the debt incurred by the city for any of the upcoming projects listed on the ballot is paid off in timely fashion — especially if for some reason revenue from the tax is severely impacted in a negative way. DeWaard says the council has otherwise committed several times to maintaining a 50-50 split between paying off bonds associated with the proposed Rec Center, renovation of the Pella Community Center, and extension of University Street east (the city projects up to $17 million in debt, based on a presentation given this past April at a public meeting), with the other half continued to be used for road projects that would otherwise require property tax revenue, thus–in his words, maintaining the current balance. (FULL INTERVIEW PODCAST WITH DEWAARD AT BOTTOM OF PAGE)

“The commitment from an overall standpoint is not changing,” DeWaard says. “The last Local Option Tax talked about 50% going for quality of life projects and 50% between property tax relief and infrastructure projects and that’s the same message that’s been very loud and clear coming from city council — there’s no intention by city council to raise anyone’s property tax through this process.”

—

The ballot measure was approved by the Pella City Council on June 21st. Click here to view the presentation given to council and listen to when the vote was approved unanimously by council:

—

Cost breakdown for proposed projects associated with the Local Option Sales and Service Tax, based on financial presentation given to the Pella City Council in April 2022 (click here to read through the whole presentation):

– New Recreation Center at Pella Sports Park – $30 million to $50 million

– Pella Community Center -$5.5 million to $22 million (renovation with the Friends of the Pella Community Center would be $17.7 million)

– University Street and Baseline Drive extension – $6 million

– Relocation of the Pella Soccer Complex to the Pella Sports Park – $2.8 million

– Potential solution for a dog park – $310,000 to $472,000

In order to pay for the projects, the Pella City Council is expected to issue up to $17 million in bonds, which would be paid for with approximately half of the projected revenue expected over the next 20 years if the levy is extended. Current cash of hand of up to $5 million will also be allocated to the effort. The rest of the projects would be paid for with private donations–currently, $12 million is committed from Vermeer Charitable and Pella Corporation, and other local corporations.

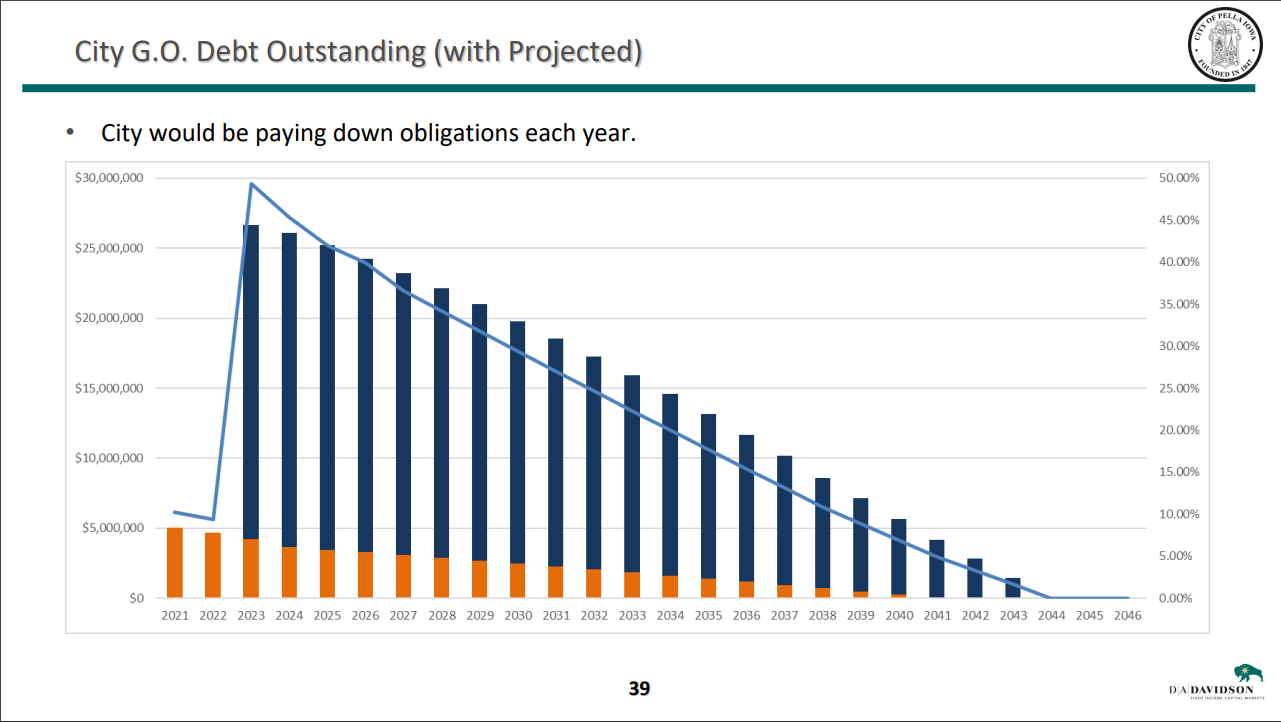

When combined with existing debt load, a $17 million bond loan amount would put the city at approximately 45% of its general obligation debt limit, which would drop annually assuming no other lending is used during that time frame.(read more here)

The Pella City Council will work to acquire additional support from county and state government and will begin fundraising if the current Local Option Sales and Service Tax is extended.

—

Current Local Option Sales and Services Tax

– The city’s current LOSST, which was approved by the citizens of Pella on March 1, 2011 with 85% support, is set to expire on December 31, 2023.

Listed below is a summary of the projects funded with the current LOSST:

– LOSST revenue $14,600,000

– Marion County redistribution $3,600,000

Total revenue $18,200,000

– Indoor pool $3,700,000

– Sports Park $3,450,000

– Quality of life projects $2,000,000

– Street projects/property tax relief $9,050,000

Total expenditures $18,200,000

—

If the measure fails:

If the current tax is not approved for extension on September 13th, there will be more opportunities to extend the levy before it expires, and the city begins forfeiting any potential revenue until it would be re-established, if it ever is:

Iowa Code section specifies the dates on which a public measure election may be held sets the following dates as public measure dates for all counties, cities, schools and merged areas:

– the first Tuesday in March

– the second Tuesday in September

Referendums can also be placed on the November ballot in city/school years (odd numbered).

Mayor DeWaard and the Pella City Council have discussed at related meetings to those involving action or policy and planning about the LOSST initiative that to stay on the timeline for all proposed projects, the sooner the funding stream is passed, the sooner work can begin on specific engineering contracts and ultimately construction, and thus, any delays in extension could then also push back the start date for extending University Street, breaking ground on a new rec center, or renovations to the Pella Community Center.

If approved:

The Pella City Council will still need to approve all related projects at future meetings, including engineering contracts (if not already approved), design plans, possible zoning changes, and ultimately, final contracts and contractors, as well as the final costs. The sales tax revenue is set to sunset at the end of 2044, and thus, could be used to loan against for any of the projects specified on the ballot.

Podcast: Play in new window | Download

Subscribe: Google Podcasts | RSS | More